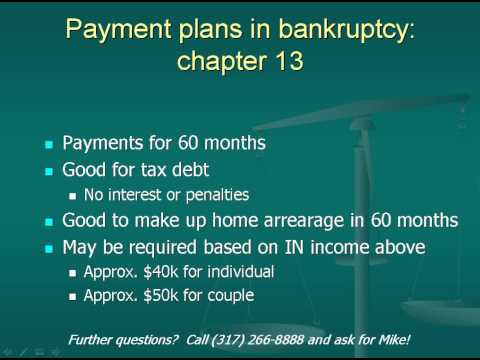

Well, hi ladies and gentlemen! I'm your host, Mike Norris. We're going to talk about Chapter 13 bankruptcy, and I'm an attorney here in Indiana. I do a lot of that kind of work, hoping to assist you with a basic understanding so you don't have to worry too much about what can be complex legal topics. I have practiced law for 33 years and really enjoy these YouTube videos because, frankly, as a former full-time college professor, I've always thought that knowledge is power. The more you know about your personal affairs, the less you have to worry. I have provided my phone number for you to call me if you have any questions. I am a lawyer in Indiana and pretty conversant with the law there. Other states may have various changes that make it a little bit different, so I encourage you to always consult with a lawyer who practices in the state where you live to get the very best advice. Because I'm an attorney, I have to tell you that this is advertising material. But let's talk a little bit about the purpose of this video. What we're trying to do is discuss Chapter 13 bankruptcy, how it works, the ins and outs, the mechanics. In this short video, we won't get too far, but we're going to take a run at it and do the very best we can. I want to discuss how to protect your home, car, wages, and other assets in bankruptcy. Payment plans in bankruptcy are referred to as Chapter 13s. The reason they're called Chapter 13 is that the book for bankruptcy is Title Eleven in the United States Code, and the seventh chapter relates to the liquidation of debt without a payment plan (that's Chapter 7), while the...

Award-winning PDF software

Video instructions and help with filling out and completing Where Form 843 Bankruptcy