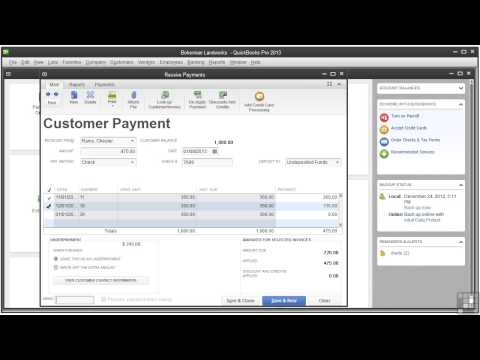

This video covers what happens when a customer pays more than what is owed. It also covers how to handle discounts for early payments. When you record a customer payment that's more than the full amount of the invoice, QuickBooks asks you how you want to handle the overpayment. I'm going to show you two scenarios. First, the customer with one invoice. So let's choose it from the customers menu. Go to customers and then go to receive payments. We'll choose the customer Dante Dallara. He paid nine hundred instead of the 886, so we'll type 900 and press tab and enter the check number. Here you can see that QuickBooks has selected the invoice and applied the 886 to the invoice. It also indicates that there's an overpayment of $14. When you choose to leave the credit to be used later and save the payment, QuickBooks will give the customer a credit. The next time you create and save an invoice for the customer, QuickBooks will mention that there is a credit available and ask what you want to do. If the customer prefers a refund, select the option to refund the amount to the customer, and QuickBooks will create a refund using the payment method that you choose. But let's leave it as a credit to be used later. Ok, on to the second scenario. Let's click Save and new. QuickBooks reminds you that there is the overpayment, and you could print the credit memo right away or you could use the credit later when you create the invoice. So let's just click OK. The next customer is Chester Raines and he just paid four hundred and seventy-five instead of the three hundred and sixty invoice amount. So we'll enter four seventy-five and write the check number. Here...

Award-winning PDF software

Video instructions and help with filling out and completing How Form 843 Overpayment