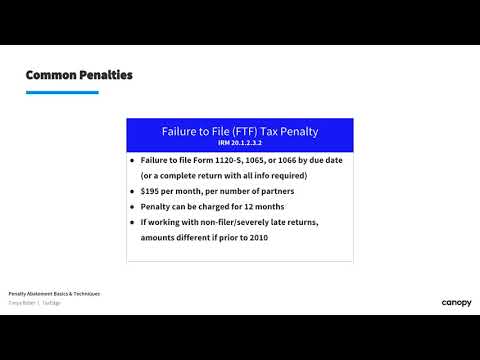

Thank you for joining today's penalty abatement basics and techniques course. Just a little quick bit about me, I've been doing this for more than 25 years. I am an enrolled agent and I get to teach and speak quite often. I'm thrilled that you decided to choose this course. Today, we will be covering an overview of penalties, how they are calculated, the Internal Revenue manual part 20 which deals with penalties and interest, and an introduction to the RCA. We will also discuss remedies such as the first time abatement program and reasonable cost considerations. The purpose of penalties is to encourage compliance from taxpayers in our voluntary tax system. However, with every new bill and tax law, the number of penalties has substantially increased, causing liability rates to rise. There are different types of penalties, including estimated tax penalties, collection related penalties, accuracy related penalties, preparer penalties, and civil penalties. For example, failure to file an information return like a 1099 or w-2 can result in a civil penalty. Estimated tax penalties behave more like interest and have a fixed rate that is currently around 4%. Failure to file penalties, on the other hand, are calculated at 5% of the unpaid tax for each month or partial month, with a maximum penalty of 25%. There is also a minimum penalty of $205, which is adjusted for inflation every year. Companies have a different type of failure to file penalty, with a rate of $195 per month per number of partners for up to twelve months for incomplete or late filings. If you are working with a non-filer or have any questions, please don't hesitate to reach out.

Award-winning PDF software

Video instructions and help with filling out and completing How Form 843 Basics