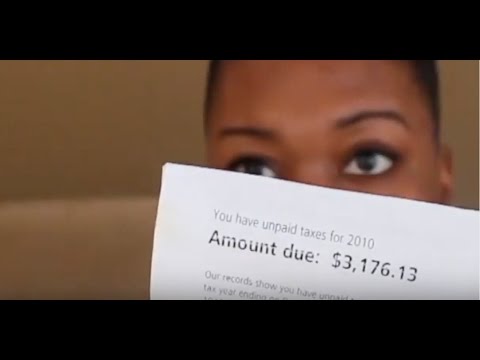

Hey, you! Through this Erica, today I'm going to talk to you about the IRS. So, what I want to talk to you about is how I negotiated a compromise and offer for a debt of over $8,000 down to one hundred and eighty-five dollars. So, if you're interested in an offer and compromise for your tax debt, stay tuned. First things first, I do want to issue a disclaimer. I am in no way suggesting that you avoid paying your taxes, that you're delinquent, or that you avoid the IRS. This is not about that. This is basically about me not being educated since 2009 and prior regarding my tax debts. I believe these debts started around 2009 and have continued to grow. I didn't make the necessary adjustments to rectify and satisfy those debts. The reason I was in debt to the IRS was that I didn't have any children, wasn't in school, and wasn't getting any write-offs or deductions. Also, I didn't have my W-4 set up correctly, so the taxes I was paying throughout the year weren't enough to satisfy what I owed the following year. I was just not educated, and I was young. The debts continued to accumulate year after year, and it became a point where I had to figure out a resolution. I'm going to give you information on an offer and compromise, which is basically something that you submit or petition to the IRS to satisfy a debt for less than what you owe. The IRS will consider it generally if they feel like you wouldn't be able to satisfy it within two years or that your income wouldn't be enough to satisfy it within two years. Under those conditions, they will consider your offer to see if it's adequate and...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 843 Revenue