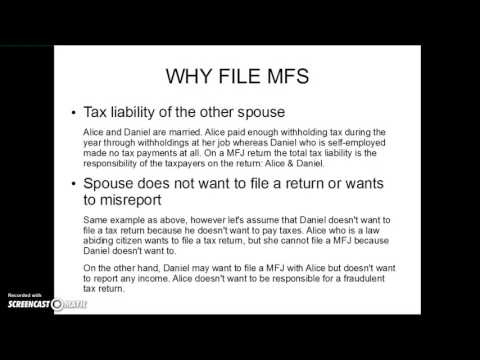

A taxpayer who would otherwise be qualified for married filing joint can file as married filing separate. The requirements for married filing joint and married filing separate are the same. The taxpayer has to be legally considered married out of the last date of tax year. However, the difference is that the taxpayers decide to file separately rather than jointly. On a married filing joint return, both spouses need to consent and decide to include all their income and expenses and file one return. The difference in married filing separate is that one spouse decides to file a separate return. So, if both spouses want to file a joint return, there is generally no scenario where married filing separate would be chosen. It is more beneficial to file a joint return rather than a separate return. However, a married filing separate return is generally done in a case where one spouse does not want to file the tax return with the other or does not consent. We are going to look at why they might do that. The married filing separate filing status generally has the worst tax consequences for the taxpayer, as they will lose certain credits and the tax rates will be higher, especially when compared to married filing joint. Let's look at why a married person might want to file separately instead of joint. The first reason is the tax liability to the other spouse. Here's an example: Alice and Daniel are married. Alice paid enough withholding tax during the year through withholdings at her job, whereas Daniel, who is self-employed, made no tax payments at all. On a married filing joint return, the total tax liabilities are the responsibility of both taxpayers on the return, who happen to be Alice and Daniel. In this case, Alice may...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 843 Dependents