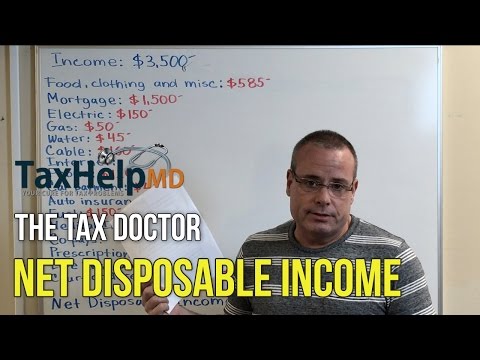

Dean Michael, the tax doctor, is here, CEO and founder of Tax Help MD. Today, I want to talk to you about the equation used to figure out which programs you qualify for, specifically the hardship programs offered by the IRS. The equation used is to determine your NDI, or your Net Disposable Income. In order to determine your NDI, the IRS takes your total household income and subtracts what they call absolute necessary living expenses. These expenses include food, clothing, miscellaneous, housing, transportation, and medical expenses. Anything else is not considered by the IRS. This means they don't care if you have children in private schools, if you're paying student loans, or if you have old medical bills. All that matters to them is what you need to live, breathe, eat, and work. To illustrate this calculation, let's take the example of a taxpayer with $3,500 in income. The IRS uses a national standard for food, clothing, and miscellaneous expenses. The specific amount is determined by the county you live in and the number of people in your household. In this particular equation, with one person in the household, you can subtract $585 for food, clothing, and miscellaneous expenses without having to provide detailed proof of each individual expense. Next, we need to consider your mortgage or rent. If you're a homeowner, the mortgage amount will include taxes and insurance. In this example, the mortgage amount is $1,500. Another factor to consider is your utilities, including electricity, gas, water, cable, internet, and phone bills. I won't go through all the numbers here as they are shown on the board, but you get the idea. Other expenses to consider include car payments, auto insurance, fuel costs for commuting to work, medical insurance, co-pays, prescription costs, life insurance (either whole life...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 843 Withholding