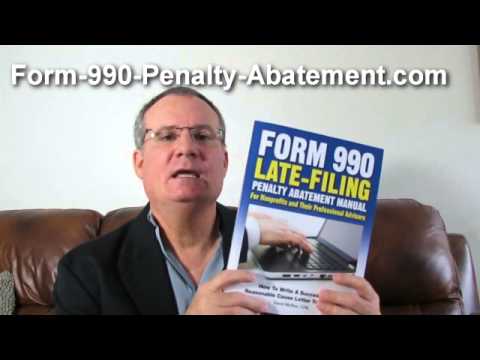

Hi, this is David McCray. I'm a CPA and I help nonprofit organizations avoid paying ridiculous penalties to the IRS simply because they failed to file form 990 by the due date. I'm very happy to announce that I have just had my ebook, which has been selling successfully for the last four or five years, printed and now offered as a printed manual. It's about 150 pages and includes a useful table of contents, an index, and not only the instructions and my five-step system for crafting a reasonable cause penalty abatement request letter, but also a letter template and the full text of more than seven letters that were successfully used to have IRS late filing penalties abated. Now, I'll just give you a quick look at the thickness of the book. As I said, it's around 150 pages. The reason I had the printed manual made is that a lot of people said they found the ebook helpful but preferred to hold a book in their hand, making it easier to refer to and search around in. It's also a lot easier for them to read and digest compared to reading an ebook on-screen. I believed it was worth putting in the time to format it for print since I was selling enough and had many testimonials attesting to its usefulness. The printed manual is available on my website, form990help.com, and form990penaltyabatement.com. You can also order it on . So, what's the difference in ordering it from me versus ordering it from ? Well, if you order it from , you'll receive the printed book. If you order it from me, you'll not only get the printed book but also the ebook and a Microsoft Word document containing the letter template and the seven sample letters. This...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 843 Edition