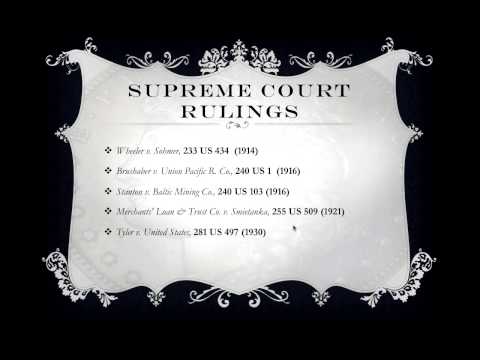

The term "income" is not used in the Constitution, and it is not to be found anywhere in the income tax act. As Brush Aver points out, it could only imply that the definition of income is the same as it was in 1787 when the Constitution was drafted. So, to clarify, the Constitution was written in 1787 and ratified in 1789. When it was written, income would not have included wages or other compensation for labor; it would have referred to earnings on land or capital, such as crop sales, rents, interest, dividends, or capital gains. Compensation for labor would have been considered an equal exchange. The use of the word "income" at that time in 1787 would have meant an exchange of labor for something of value, like barter. If an employer doesn't immediately pay an employee but lends them money temporarily, and later pays with interest added, the interest would be considered income on the labor. However, the wages themselves, or the money paid for the labor, would not be considered income. They are the principle on which the interest is calculated. In conclusion, it is crucial to read and understand this extensively detailed case, despite its verbosity, as it provides valuable insights.

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 843 Wage