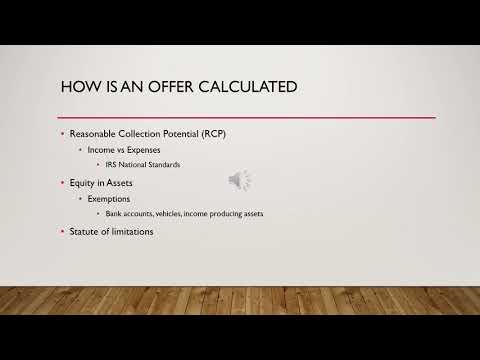

One of the most sought-after resolution options for those who owe back taxes is the IRS offering compromise. Today, I'm going to go through with you some of the eligibility requirements for the offer and discuss how the IRS goes about determining whether or not somebody qualifies for this program. The first thing we want to talk about is what isn't offered in compromise. An offering compromise is a program offered by the IRS that allows taxpayers to settle their tax debt for less than they owe. For eligible taxpayers, this program can be a way to significantly reduce your tax debt and make it more affordable to pay and resolve any outstanding back taxes. However, one common misconception about the offering compromise is that people think that just because they owe back taxes, they qualify for a settlement. However, this is not the case. Not everyone qualifies for an offer and compromise. There are many test circumstances and factors that go into determining whether or not a taxpayer that owes back taxes is going to be able to qualify for this program. In 2012, the IRS rolled out their Fresh Start initiative. Through this program, they expanded the offer and compromise, making more taxpayers eligible and making it easier for taxpayers not only to qualify but to follow through with the payment terms of the offer and compromise. So, the first question that everybody wants to know is: are they going to qualify for an offer and compromise? There is essentially a three-part prong test for determining whether or not you're going to qualify. The first thing that you're going to look at is the amount of taxes owed. Generally, a taxpayer that owes more than $10,000 is going to qualify for this program. However, contrary to what you would think, it's...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 843 Publications