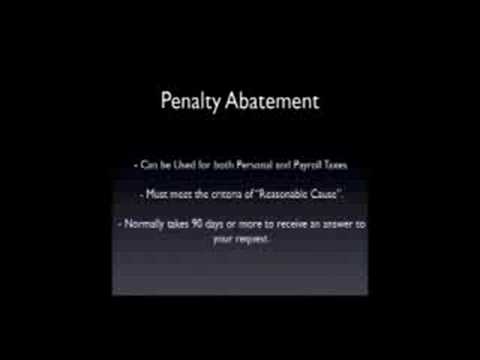

IRS penalty abatement is a potential solution for resolving IRS problems. However, there are specific cases where penalty abatement may not be applicable. One such case is when the taxpayer plans to resolve the issue through full payment or bankruptcy, as penalty abatement might not make sense in these situations. Another instance is when the taxpayer intends to settle the entire case through an accepted offer and compromise. In all other IRS problem resolution cases, penalty abatement is a viable option. If the taxpayer is entering into an installment agreement or facing hardship status where collection is halted but interest and penalties continue to accrue, it is wise to consider requesting penalty abatement. A written explanation should be provided, demonstrating reasonable cause for the failure to file or pay taxes on time. Reasonable cause refers to unforeseen circumstances despite exercising ordinary business care and prudence. For instance, if a hurricane destroyed business records and hindered tax filing and payment, it could serve as a reasonable cause explanation. It is important to note that the longer the taxpayer's failure to comply persists, the harder it becomes to obtain penalty abatement. Continuously neglecting tax obligations for extended periods may reduce the likelihood of approval. Typically, the process for penalty abatement takes about 90 to 180 days. The IRS might respond with a letter stating that full payment of taxes is necessary before considering the abatement request. However, this is an incorrect interpretation of the law. Taxpayers can challenge this response by writing a strong, persuasive letter emphasizing that the law does not require full payment before considering penalty abatement. To ensure the abatement request is received and processed, it is recommended to send it via certified mail with return receipt requested to the appropriate service center. Additionally, addressing the letter to the...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 843 Claiming